As Cash Offer vs. Mortgage: Best Way to Buy a Home in Georgia in 2026 takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the following paragraphs, we will delve into the key differences between a cash offer and a mortgage when it comes to purchasing a home in Georgia in 2026.

Cash Offer vs. Mortgage in Real Estate

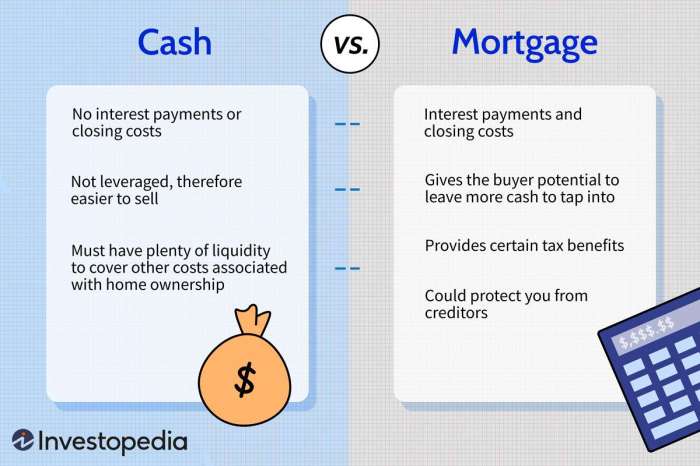

When it comes to buying a home, one of the key decisions you'll need to make is whether to make a cash offer or use a mortgage. Both options have their own set of advantages and disadvantages, which can significantly impact your home buying experience.

Cash Offer

Making a cash offer in a real estate transaction involves using your own funds to purchase the property outright, without the need for a mortgage loan. This means you pay the full purchase price in cash, which can be appealing to sellers as it eliminates the risk of a loan falling through.

- Advantages of a Cash Offer:

- Quick transaction process

- No need for a mortgage approval

- Potential for negotiation power with sellers

- Disadvantages of a Cash Offer:

- Ties up a significant amount of liquid assets

- Potential loss of investment opportunities with cash tied up in a property

Mortgage

On the other hand, using a mortgage to buy a home involves borrowing money from a lender to finance the purchase. The property serves as collateral for the loan, and you make monthly payments to repay the borrowed amount plus interest over a specified period.

- Advantages of a Mortgage:

- Preserves liquidity by spreading out payments over time

- Opportunity to invest cash in other ventures

- Potential tax benefits on mortgage interest payments

- Disadvantages of a Mortgage:

- Longer transaction process due to loan approval requirements

- Interest payments increase the cost of the home over time

- Risk of foreclosure if unable to make mortgage payments

Pros and Cons of Cash Offers

When it comes to buying a home, opting for a cash offer can have its advantages and disadvantages. Let's explore the benefits and drawbacks of choosing to purchase a property with cash.

Benefits of Cash Offers

- Immediate Closing: Cash offers typically result in quicker closing times since there is no need for lender approval or financing processes.

- Negotiating Power: Sellers often prefer cash offers as they are not contingent on a loan approval, giving buyers more leverage in negotiations.

- Cost Savings: By eliminating the need for a mortgage, buyers can save on loan origination fees, interest payments, and other closing costs associated with traditional financing.

Drawbacks of Cash Offers

- Opportunity Cost: Using cash to purchase a home means tying up a significant amount of capital that could potentially be invested elsewhere for a higher return.

- Lack of Liquidity: Once cash is used to buy a property, it can be challenging to access those funds quickly in case of emergencies or other financial needs.

- Missed Tax Benefits: Buyers who opt for a cash offer may miss out on potential tax deductions associated with mortgage interest payments.

Examples of When a Cash Offer is More Advantageous

In situations where a seller is looking for a quick and hassle-free transaction, a cash offer can be very appealing. Additionally, in competitive real estate markets where multiple offers are common, a cash offer can give buyers a competitive edge over those relying on financing.

Benefits and Drawbacks of Mortgages

When it comes to buying a home in Georgia in 2026, using a mortgage can offer several advantages, but it also comes with its own set of challenges and risks. Understanding the impact of mortgages on the overall cost of purchasing a home is crucial for making an informed decision

Advantages of Using a Mortgage

- Mortgages allow you to purchase a home without having to pay the full purchase price upfront, making homeownership more accessible to a wider range of people.

- By spreading out the cost of the home over a longer period, mortgages can make monthly payments more manageable and fit within your budget.

- Building equity in the home over time through mortgage payments can be a smart long-term investment strategy.

- Mortgage interest payments may be tax-deductible, providing potential financial benefits.

Challenges and Risks of Obtaining a Mortgage

- Qualifying for a mortgage can be a challenging process, as lenders will assess your financial history, credit score, and income to determine your eligibility.

- If you fail to make your mortgage payments, you risk losing your home through foreclosure, which can have long-lasting financial consequences.

- Interest rates on mortgages can fluctuate, impacting the total amount you end up paying over the life of the loan.

- Mortgages come with various fees and closing costs that can add to the overall cost of buying a home.

Impact of Mortgages on the Overall Cost of Buying a Home

- While mortgages allow you to purchase a home with a smaller initial outlay of cash, the total cost over time can be significantly higher due to interest payments.

- The length of the mortgage term and the interest rate can greatly affect the total amount you pay for your home.

- Choosing the right mortgage type and terms can help you minimize costs and maximize the benefits of homeownership.

Real Estate Trends in Georgia for 2026

In 2026, the real estate market in Georgia is projected to experience several key trends that will impact the decision-making process for potential homebuyers. These trends are crucial to consider when deciding between a cash offer and a mortgage.

Shift Towards Urban Living

One of the notable trends in Georgia's real estate market for 2026 is the continued shift towards urban living. With more people seeking convenience and access to amenities, urban areas are becoming increasingly popular for homebuyers. This trend may influence the choice between a cash offer and a mortgage, as urban properties tend to have higher price tags.

Increasing Demand for Sustainable Homes

Another trend shaping the real estate landscape in Georgia is the growing demand for sustainable homes. Buyers are placing a higher value on energy-efficient features and environmentally friendly practices. This trend could impact the decision between a cash offer and a mortgage, as sustainable homes may come at a premium.

Rise of Virtual Real Estate Transactions

In 2026, the real estate industry in Georgia is expected to see a rise in virtual transactions. With advancements in technology, more buyers are opting for virtual tours and online transactions. This trend may influence the choice between a cash offer and a mortgage, as virtual transactions could streamline the buying process.

Closing Summary

In conclusion, the decision between a cash offer and a mortgage hinges on various factors, each with its own set of advantages and disadvantages. Navigating through these intricacies can lead to a well-informed choice that aligns with your financial goals and homeownership aspirations.

Query Resolution

What are the tax implications of choosing a cash offer over a mortgage?

Choosing a cash offer means you won't have mortgage interest tax deductions, but you also won't have mortgage insurance premiums. Consult with a tax professional for personalized advice.

Can a cash offer help in a competitive real estate market?

Yes, a cash offer can make your bid more attractive to sellers in a competitive market since it eliminates financing contingencies.

Are there any additional costs associated with getting a mortgage?

Apart from the down payment and monthly mortgage payments, there may be closing costs, appraisal fees, and other expenses involved in securing a mortgage.

Is it possible to switch from a mortgage offer to a cash offer mid-process?

While it's technically possible, it can complicate the transaction and may not always be feasible, so it's advisable to decide on the financing method upfront.