Exploring the world of real estate investment in Cleveland, Ohio, this guide dives into the lucrative opportunity of buying a house as a rental property. From market insights to financial strategies, this comprehensive overview sets the stage for a successful investment journey.

Overview of Rental Property Investment in Cleveland, Ohio

When considering investment opportunities in the real estate market, Cleveland, Ohio, stands out as a promising location for rental property investment. With a growing economy and a stable housing market, Cleveland offers numerous advantages for investors looking to generate passive income through rental properties.

Real Estate Market in Cleveland

Cleveland's real estate market has been experiencing steady growth in recent years, making it an attractive option for investors. The city offers a diverse range of properties, from single-family homes to multi-unit buildings, catering to different investment preferences.

Advantages of Investing in Cleveland

- Affordable Housing: Cleveland offers relatively affordable housing options compared to other major cities, making it more accessible for investors looking to enter the real estate market.

- Strong Rental Demand: The city has a high demand for rental properties, driven by a growing population and a steady influx of young professionals and students.

- Stable Market: Cleveland's real estate market is known for its stability, with property values remaining consistent over time, providing a secure investment environment.

Key Factors Influencing the Rental Market in Cleveland

- Economic Growth: Cleveland's economy has been steadily growing, leading to increased job opportunities and population growth, which in turn drives demand for rental properties.

- University Presence: With several universities and colleges in the city, there is a constant demand for student housing, creating opportunities for investors to cater to this niche market.

- Infrastructure Development: Investments in infrastructure projects, such as transportation and amenities, contribute to the overall appeal of Cleveland as a desirable location for renters.

Benefits of Buying a House for Rental Purposes

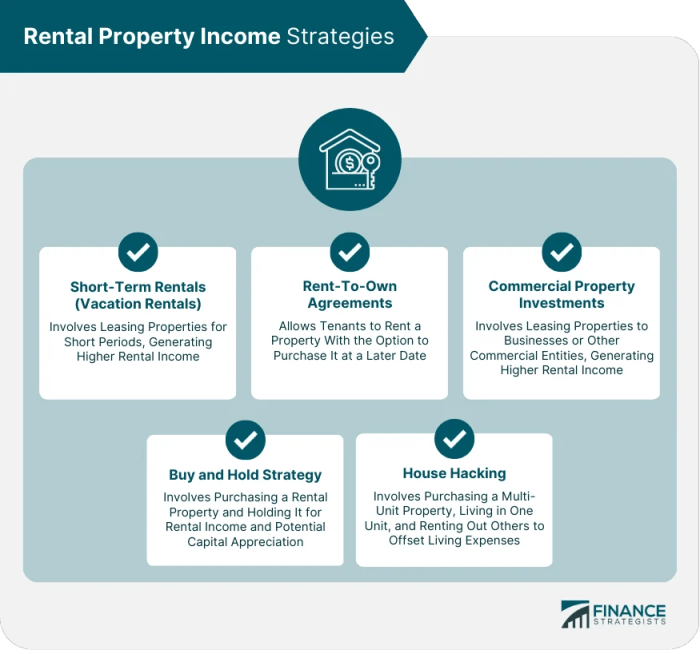

Investing in real estate and purchasing a house for rental purposes can offer numerous advantages for investors looking to build wealth and generate passive income streams. Rental income is a key benefit of buying a house for rental purposes. By renting out the property to tenants, investors can receive a steady stream of income on a monthly basis.

This rental income can help cover the mortgage, property taxes, maintenance costs, and even generate profits for the investor.

Passive Income Generation

- Rental income provides investors with a passive income stream, allowing them to earn money without actively working for it.

- Investors can use rental income to cover property expenses and generate additional cash flow for savings or other investments.

- Over time, rental income can increase as property values appreciate, providing investors with a reliable source of income.

Tax Benefits

- Owning rental properties comes with various tax benefits, including deductions for mortgage interest, property taxes, insurance, maintenance costs, and depreciation.

- Investors can also benefit from capital gains tax advantages if they decide to sell the property after it has appreciated in value.

- Additionally, rental income is typically taxed at a lower rate compared to regular income, providing investors with a tax-efficient investment strategy.

Factors to Consider Before Buying a House for Rental in Cleveland

When looking to invest in a rental property in Cleveland, there are several key factors to consider that can greatly impact the success of your investment.

Location

The location of the property is crucial when buying a house for rental purposes. Consider factors such as proximity to amenities, schools, public transportation, and job centers. A good location can attract quality tenants and ensure a steady rental income.

Property Type

The type of property you choose to invest in also plays a significant role. Single-family homes, multi-family units, condos, or townhouses each have their own pros and cons. Evaluate your budget, maintenance responsibilities, and target tenant demographic when selecting the property type.

Budget

Establishing a realistic budget is essential before purchasing a rental property. Consider not only the initial purchase price but also ongoing expenses such as property taxes, insurance, maintenance costs, and potential vacancies. Ensure that your budget allows for a comfortable cash flow and a buffer for unexpected expenses.

Neighborhood Quality

The quality of the neighborhood can greatly impact the success of your rental property investment. A safe, well-maintained neighborhood with good schools and amenities is likely to attract higher quality tenants and command higher rental rates. Conduct thorough research on the neighborhood's crime rate, school ratings, and overall desirability before making a purchase.

Market Trends and Rental Demand

Keeping an eye on market trends and rental demand in Cleveland is crucial for making informed investment decisions. Look for neighborhoods experiencing growth and development, as this can indicate a strong rental market. Analyze rental rates, vacancy rates, and population trends to ensure there is demand for rental properties in the area you are considering.

Financing Options for Buying a Rental Property in Cleveland

When it comes to purchasing a rental property in Cleveland, there are various financing options available. Each option comes with its own set of pros and cons, which can significantly influence your investment strategy. Understanding these financing options and evaluating their feasibility is crucial for making an informed decision.

Comparing Financing Options

- Loans: Taking out a loan from a bank or financial institution is a common way to finance a rental property purchase. While loans provide leverage and allow you to invest with less cash upfront, they also come with interest payments that can impact your cash flow.

- Mortgages: Getting a mortgage to buy a rental property involves borrowing money from a lender and using the property as collateral. Mortgages offer long-term financing options, but you'll need to make monthly payments, including interest and principal, which can affect your profitability.

- Cash: Paying for the rental property in cash means you won't have to deal with interest payments or loan terms. However, tying up a large sum of money in one investment may limit your ability to diversify your portfolio.

Evaluating Financial Feasibility

Before deciding on a financing option, it's essential to assess the financial feasibility of buying a rental property. Consider factors such as rental income potential, property expenses, vacancy rates, and overall market conditions.

- Calculate the potential rental income: Estimate the monthly rent you can charge based on market rates and occupancy levels.

- Account for expenses: Factor in costs such as property taxes, insurance, maintenance, and property management fees.

- Analyze the cash flow: Determine if the rental income will cover expenses and provide a positive cash flow after financing costs.

- Assess the market conditions: Consider the current real estate market trends in Cleveland and the potential for property appreciation.

Property Management Strategies for Rental Houses in Cleveland

Effective property management is essential for maintaining a successful rental property in Cleveland. Here are some strategies to consider:

Finding Reliable Property Management Services

- Research and interview multiple property management companies to find the right fit for your rental property.

- Check reviews and references to ensure the company has a good reputation for managing rental properties in Cleveland.

- Verify that the property management company is licensed and experienced in handling rental properties similar to yours.

Importance of Regular Maintenance and Upkeep

- Schedule regular inspections and maintenance to address any issues promptly and prevent costly repairs in the future.

- Keep the property clean, well-maintained, and updated to attract and retain quality tenants.

- Invest in landscaping and curb appeal to enhance the overall value of your rental property.

Handling Tenant Issues for a Smooth Rental Experience

- Establish clear communication channels with tenants to address any concerns or maintenance requests promptly.

- Set clear expectations in the lease agreement regarding rent payments, property rules, and maintenance responsibilities.

- Respond to tenant issues professionally and promptly to maintain a positive landlord-tenant relationship.

Legal Considerations and Regulations for Rental Property Owners

When renting out a property in Cleveland, it is crucial to understand the legal requirements that apply to rental properties. Landlord-tenant laws and regulations play a significant role in shaping the landlord-tenant relationship, ensuring fair practices, and protecting the rights of both parties.

Additionally, having proper contracts and documentation in place is essential to avoid any misunderstandings or disputes in the future.

Legal Requirements for Renting Out a Property in Cleveland

- Landlord Licensing: Before renting out a property in Cleveland, landlords are required to obtain a valid rental license from the city. This license ensures that the property meets safety and habitability standards set by the local authorities.

- Lead Disclosure: Federal law requires landlords to disclose any known lead-based paint hazards in properties built before 1978. Landlords must provide tenants with the necessary information and lead disclosure forms to ensure compliance.

- Security Deposits: Ohio law regulates the handling of security deposits, including the maximum amount that can be charged, the timeline for returning deposits, and the requirements for providing an itemized list of deductions.

Landlord-Tenant Laws and Regulations in Cleveland

- Rental Agreements: It is important to have a written rental agreement that Artikels the terms and conditions of the tenancy, including rent amount, lease duration, and rules for the property. Both landlords and tenants must adhere to the terms of the agreement.

- Eviction Procedures: Ohio law specifies the legal process for evicting tenants, including the reasons for eviction, notice requirements, and court proceedings. Landlords must follow the proper procedures to evict tenants lawfully.

- Property Maintenance: Landlords are responsible for maintaining their rental properties in compliance with building and housing codes. Tenants have the right to live in a safe and habitable environment, and landlords must address any maintenance issues promptly.

Importance of Proper Contracts and Documentation

- Rental Agreement: A well-drafted rental agreement helps establish clear expectations for both landlords and tenants, reducing the likelihood of disagreements or disputes. It also serves as a legal document that can be used to enforce terms if necessary.

- Record-Keeping: Keeping thorough records of rental payments, repairs, communications with tenants, and other relevant information is crucial for documenting the landlord-tenant relationship. Good record-keeping can help protect landlords in case of legal disputes.

- Legal Compliance: By having proper contracts and documentation in place, landlords can ensure that they are complying with all relevant laws and regulations governing rental properties in Cleveland. This can help prevent legal issues and potential liabilities down the line.

Wrap-Up

As we wrap up our discussion on investing in rental properties in Cleveland, Ohio, it's clear that the potential for growth and passive income is substantial. With the right knowledge and resources, navigating this market can lead to a rewarding and profitable venture.

Questions and Answers

What are the tax benefits of owning rental properties in Cleveland?

Owners can enjoy tax deductions on mortgage interest, property taxes, insurance, maintenance costs, and depreciation.

How can I evaluate the financial feasibility of buying a rental property in Cleveland?

Consider factors like rental income potential, property appreciation, ongoing expenses, and market trends to assess feasibility.

What legal requirements should I be aware of when renting out a property in Cleveland?

Ensure compliance with zoning laws, fair housing regulations, and licensing requirements to avoid legal issues.